portability real estate taxes florida

What is Property Tax Portability. Calculated cap 31250.

What Is Florida Homestead Portability Epgd Business Law

Once you have completed part 1 2 print the form sign it Part 3 and return it to.

. It may be transferred to any property in Florida and is commonly referred to as PORTABILITY. To benefit from portability an application is required. Floridas Save Our Homes SOH provision allows you to transfer all or a significant portion of your tax benefit up to 500000 from a Florida home with a homestead exemption to a new home within the state of Florida that qualifies for a homestead exemption.

To transfer the SOH benefit you must establish a homestead exemption for the new home within three. Florida property owners can receive a 25000 property tax exemption for their primary residence. With the homestead portability how much can I expect to pay in taxes.

I bought my home in 2018 for 259k and I just sold it for 500k. The Save Our Homes cap limits increases in the annual assessment of a home to a maximum of 3 regardless of the increase in Market Value. If the market value was increased to 500000 through the Value Adjustment Board petition process the portability amount should be almost 200000 more.

E file for Portability when E filing for your Homestead Exemption click here. The law allows up to 2 years for transfer of the portability benefit. Hillsborough County Property Appraiser.

Click the link below to download the application. Clearwater Florida Home Buyers Guide to Pinellas Property Tax Values Part 1. This is referred to as portability.

Additional 25000 Homestead Exemption for a total of 50000 in homestead exemptions If you currently have a homestead exemption there is no action. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. In terms of 1000 home values we owe 1 in property tax.

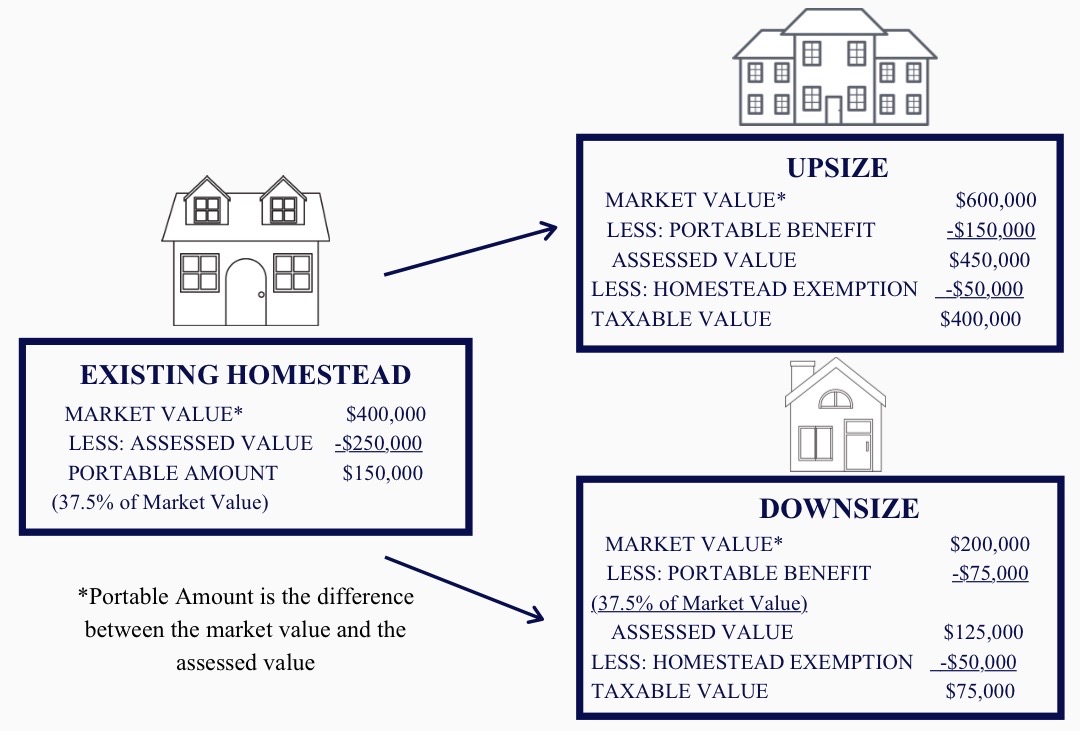

If the value of the new home is less than that of the previous homesteaded property then only a percentage of the tax savings is portable. Proportion of cap of previous homestead to just value 100000 400000 25 percent which is applied to new homesteads just value 25 percent x 250000 62500 which is then adjusted for proportion of retained ownership ½ x 62500 31250.  The new Assessed Value is equal to the Just Value of New Home Just Value of Old Home x Assessed Value of Old Home.

This estimator assumes that the application for the new homestead is made within 2 years of January 1st of the year the original homestead was abandoned. See Related articles on how to calculate these items. Take a copy of your property tax record its also available online and find the two values.

This benefit first became available in 2008. 350000 200000 150000 in Tax Benefit. Calculated assessed value 218750.

Homeowners can transfer or PORT the difference between the assessed and market values from their previous Homestead. An example of the 2 year window is if you are applying for homestead for 2020 you must have had homestead and a portability amount on your former property in 2019 or 2018 in order to transfer any portability benefit. According to state law Florida real property taxes are based on a 1 millage rate.

In Florida the first year a home receives a homestead exemption the property appraiser assesses it at just valueNow with that in mind for each of the following years the Save Our Homes Amendment SOH of the FL Constitution prevents the assessed value of said homestead property from increasing more than 3 per year or exceeding the percent change. In other words you may only go one tax year without having. If you moved to Hillsborough County from another Florida County provide the most complete address you can and be sure to include the name of the County.

You sell your current Florida Homestead that has an Assessed Value of 200000 and a Just Market Value of 350000. Florida Homestead Real Estate Tax Portability Explained. The State of Florida has a few property tax exemptions including a homestead exemption.

Tax savings due to the second 25000 homestead exemption exclude the school taxes. In the previous example if the homeowner purchases a larger home with a. Portability works for homeowners who either are purchasing a larger property or who are downsizing to a smaller property.

The maximum portability benefit that can be transferred is 500000. For those who have made a home in Florida and are considering a move to a new Florida home one of the most important things to be aware of is the newly enacted Property Tax Portability Amendment which impacts Homestead property. Property owners with Homestead Exemption also receive a benefit known as the Save Our Homes cap.

This estimator calculates the estimated. OK but what about if one is downsizing to a home of lesser value of say 125k. Im buying a new home about 15 miles away for 465.

A home in Florida can be assessed for property tax at the county level as well as a just or fair market value. Calculating Florida Property Tax Portability Benefit. An additional 25000 homestead exemption is applied to homesteads that have an assessed value of more than 50000.

Im moving from pasco county to hillsborough. The Portability Amendment literally made that tax savings portable so you can now transfer up to 500000 of your accrued Save Our Homes benefit to your new home. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

In this scenario. On the Real Estate Tax Bill or use the parcel record search. In Florida Property Tax Portability refers to the ability to transfer up to 500000 of accumulated Save Our Homes Cap Savings from an existing or prior homestead exempt property to a new property established as your homestead within two tax years of selling or abandoning your existing or prior homestead.

It was under homestead exemption. To learn more about portability click the Frequently Asked Questions link here property tax portability. Through the introduction of Amendment 1 on January 29 2008 Florida voters amended the State constitution to provide for transfer of a Homestead Assessment Difference from one property to another.

Most of Palm Beach County property tax rates vary between 15 and 2 so that is a potential to gain tax savings of 3000 to 4000 per year. If you are eligible portability allows most Florida homestead owners to transfer their SOH benefit from their old homestead to a new homestead lowering the tax assessment and consequently the taxes for the new homestead.

/arc-anglerfish-arc2-prod-tbt.s3.amazonaws.com/public/R76EFPWHBMI6TBKNIBWI6S7HAY.jpg)

Portability Benefit Can Reduce Tax Burden For Property Owners Moving Into Larger Or Smaller Homes

The Big Three Grandfathered Homesteads Portability Westchase Fl Patch

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check

Will Selling Cost You Money In Florida House Heroes Llc Tax Credits Money Management Tax Deductions

9901 Montiano Drive Naples Fl 34113 Mls 220017819 Florida Home Luxury Homes Modern Beach Homes

Ready To Buy Your First Dreamhome In Aventura What Do You Need To Know As A Single Man Woman Here First Time Home Buyers Aventura Florida Miami Real Estate

Florida Revenue Floridarevenue Twitter Disaster Preparedness Hurricane Prep Preparedness

Pin On Climer School Of Real Estate

Property Tax Portability Jennifer Sego Llc

Filing For Homestead Exemption In Florida Florida Homesteading Real Estate Information

Federal Estate Tax Portability The Pollock Firm Llc

Florida Homestead Check For Homeowners

Homestead Exemption And Portability Parkland Boca Raton Coral Springs

All 50 States Tax Lien Foreclosure Fortune Real Estate Investing Video Commercial Real Estate Investing Real Estate Investing Wholesaling Real Estate Investing

Florida Homestead Check Home Facebook

Tax Portability Transfering Your Tax Benefits From Your Old Homestead To Your New One

Property Tax Portability Jennifer Sego Llc

What Do Realtors Need To Know About The Homestead Laws Florida Homestead Check